Insights

Payment Orchestration Process: Core Modules and Workflows

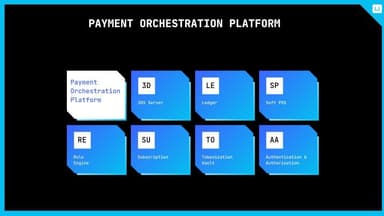

Payment Orchestration Process: Inside the Platform’s Core Modules and Workflows

Understanding the inner workings of a payment orchestration platform can give you clarity on how exactly it improves your payment operations. In this article, we explore the payment orchestration process in detail – breaking down each core module (ledger, 3DS, subscriptions, softPOS, tokenization, authorization, etc.) and showing how they come together to address real merchant pain points.

From Checkout to Settlement – What Happens? When a customer clicks “Pay” on your website or app, a flurry of behind-the-scenes steps occurs within milliseconds. Traditionally, a merchant’s system would send the transaction to a payment gateway which then goes to an acquirer, and so on. In a payment orchestration model, the orchestration platform sits in the middle of this flow, coordinating every step after that checkout click:

Transaction Intake: The platform receives the transaction details from your checkout (amount, currency, payment method, customer info, etc.) via an API call. At this point, it may generate an internal transaction ID and log the request in the ledger.

Routing Decision & Authorization (Auth): Next, the platform’s routing engine kicks in. Based on predefined rules and real-time data, it selects the best PSP/acquirer to handle the authorization. For example, if it’s a credit card payment, the platform might choose Acquirer A because that bank has the highest approval rate for the card’s country, or it might choose Acquirer B because the fee is lower for that card type. This is the auth step – essentially asking the chosen provider to authorize the payment. The orchestration layer forwards the transaction to the selected gateway/acquirer with all necessary info.

3DS Authentication (if needed): If the transaction requires 3-D Secure verification (say it’s a card payment and rules or regulations trigger an authentication), the orchestration platform will handle that as part of the flow. It might redirect the customer to a 3DS page or invoke a 3DS SDK silently in-app. The platform ensures this step is completed (possibly interacting with a third-party 3DS server or the gateway’s 3DS system) and that the result (authenticated or failed) is taken into account before proceeding. This step addresses a key compliance need (e.g., PSD2 in Europe mandates strong customer authentication for many transactions).

Fraud Screening: In many cases, a fraud check happens either just before or in parallel with the authorization. The orchestration system may run the transaction through fraud rules or call out to a fraud detection service (or multiple services). For instance, it might perform device fingerprinting, velocity checks (has this card been used too many times in a short period?), blacklist/whitelist matching, or even machine learning scoring. If the fraud module deems the transaction very high-risk (like a stolen card), it could decline the transaction before it goes to authorization to save costs. Otherwise, it passes along a risk score or simply lets the auth continue. This flexible placement of fraud checks is a pain point solver: merchants often struggled with separate fraud systems, but in orchestration, it’s seamlessly integrated, reducing false positives and giving legit customers a smoother experience.

Response Handling: Once the payment is sent for authorization, the orchestration platform waits for the response from the processor/bank – approved or declined (plus reason codes). Here, the platform’s logic branches:

If approved, great – the transaction is marked as authorized. The platform can now either complete it immediately (for instant capture payments) or hold it for a capture later (common in e-commerce when you capture only when goods ship). This status is recorded in the ledger and relayed back to your system so you can confirm the order.

If declined or timed out, this is where orchestration truly shows its value. The platform can automatically retry the transaction via a secondary route. For example, maybe Acquirer A declined it; the platform can instantly re-route to Acquirer B or to a backup gateway. This is often called cascading or failover. The customer typically doesn’t even notice this happening – they might experience a slightly longer wait (a second or two more), but ultimately the payment goes through on the second attempt. If all routes are exhausted, the platform bubbles up the final failure result to the merchant site to show an error. Without orchestration, that transaction might have simply been lost on the first decline, but with orchestration, you get additional shots at converting the sale.

Post-Authorization Actions: For successful transactions, the orchestration platform can carry out a number of post-auth steps automatically. This includes:

Captures/Settlements: If the merchant operates on an authorize-then-capture model (common for physical goods), the platform will later execute the capture (settlement) either via a manual trigger from your team or automatically at a set time (end of day batch, etc.). The platform’s ledger will link the capture to the original auth, ensuring traceability.

Receipt and Ledger Entry: The transaction details (amount, fees, which gateway was used, timestamps, etc.) get recorded in the internal ledger. This builds the audit trail. If the platform has a transactional ledger feature, it might also reflect this in a double-entry accounting system for internal balances (useful for marketplaces that hold funds, for example).

Notification & Webhooks: The platform sends a callback or webhook to your systems to inform that payment was successful (or ultimately failed). This triggers your business logic (e.g., provisioning a service or confirming an order to be shipped).

Tokenization: If the payment method is eligible for storing (e.g., a credit card or a direct debit mandate), the platform will tokenize the details at this point (if it wasn’t done earlier) and store the token in its vault. It can then return the token to you or keep it associated with the customer’s profile for future use. Pain point solved: Without this, you might have had to store sensitive data or integrate a separate token service; the orchestration does it as part of the normal flow, seamlessly securing card data for you.

Exception Handling and Alerts: The orchestration process also includes robust error handling. Suppose a particular gateway is down or responding slowly – the platform can detect this (through failed requests or latency thresholds) and automatically divert new transactions away from that provider (a feature often called adaptive routing). It may also alert your team through the dashboard or email/SMS if a provider outage is detected, or if overall approval rates drop below a threshold. This proactive monitoring is something merchants historically had to do manually (e.g., noticing in an ops dashboard that many payments are failing), but the platform’s business rules can automate it.

Reconciliation and Settlement Matching: Later in the process, when you receive settlements from various acquirers (sometimes daily deposits to your bank account), the orchestration platform’s reconciliation module comes into play. It takes the reports from each provider (which detail which transactions funded the deposit) and matches them against the platform’s own ledger of transactions. If any discrepancies are found (say an expected transaction didn’t fund, or amounts differ due to fees), it flags them for investigation. This automates a traditionally painstaking accounting task.

Throughout these steps, the orchestration platform’s modules work in concert. Let’s look at some of those core modules individually and how they alleviate specific pain points:

Transaction Routing & Authorization Module (Smart Routing)

What it is: The component that chooses the path for each payment and executes the authorization with the chosen endpoint.

Merchant pain point: Without smart routing, a merchant might stick with one processor and suffer higher decline rates or fees. If that processor has an outage, the merchant is essentially out of business until it’s resolved – a single point of failure.

How orchestration helps: The routing module maintains connections to multiple gateways/PSPs. It can dynamically select one based on configured rules (e.g., route 70% of traffic to your primary provider and 30% to a secondary for A/B testing), or dynamic conditions (like which provider had the highest success rate for a BIN or country in the last hour). It also performs failover as described. By having this flexibility, merchants see more transactions approved (one provider’s “decline” might be another’s success) – for instance, an orchestrator’s smart routing and cascading features can yield a 15% increase in acceptance rates according to results seen with platforms like IXOPAY. Additionally, it prevents gateway lock-in: you’re not at the mercy of any single provider’s policies or outages. If tomorrow a new payment method becomes popular (say a digital wallet), the routing module can incorporate it alongside card processing, sending transactions via that wallet’s API when customers choose it.

In practice, merchants configure routing rules in the platform’s dashboard. For example, “If card type is Amex, use Processor X; if Visa/Mastercard, use Processor Y for US cards and Processor Z for EU cards.” The module then obeys these rules in real time. It also tracks outcomes – many platforms offer analytics where you can see approval rate by provider, helping you refine the routing logic. This continuous optimization is a game-changer for enterprises that operate in many markets, because the “best” route can change over time or by circumstance, and the orchestration layer adapts without heavy manual intervention.

3DS and Authentication Module

What it is: The component that handles customer authentication flows like 3-D Secure, ensuring that a transaction is authenticated when required by issuers or regulations.

Merchant pain point: Implementing 3DS was historically painful – you’d integrate a 3DS SDK or rely on each gateway’s 3DS support (which might differ). Also, balancing when to use 3DS (to prevent fraud but not hurt conversion) can be tricky.

How orchestration helps: In an orchestration platform, 3DS is often built-in or uniformly managed. The platform can apply 3DS to transactions based on smart rules (like only apply 3DS for transactions above $100, or for new customers, or for certain markets that mandate it). This means the merchant doesn’t have to hard-code those rules; the platform does it. When triggered, the module conducts the authentication process – it might integrate with services like Visa Secure (3DS 2.0) directly or via an ACS (Access Control Server) provider. The benefit is a consistent authentication strategy across all payment providers. For example, if you have 3 gateways, you don’t need to worry about how each does 3DS – the orchestrator handles it and then passes the necessary authentication data to whichever gateway is authorizing the payment. The result is increased security and compliance without reinventing the wheel for each integration. It also improves customer trust (they see the familiar bank OTP or biometric prompt when needed) and reduces fraud.

Post-authentication, this module logs the result (authenticated, or attempt, or failed) which can be used in fraud decisions too. Modern orchestration platforms fully support 3DS 2.x, enabling smooth mobile authentication flows (like in-app biometrics), which can actually improve conversion in markets where it’s expected by customers.

Tokenization & Vault Module

What it is: A secure vault service that stores sensitive payment details and returns non-sensitive tokens.

Merchant pain point: Storing card data securely is expensive (PCI compliance) and risky. Yet customers demand features like saved cards for quick checkout or recurring payments. Without a vault, merchants either cannot save cards or they take on huge compliance burdens.

How orchestration helps: Most payment orchestration platforms come with a PCI-DSS Level 1 certified vault. When a customer enters their card details on your site (often via a secure form or iFrame from the platform to ensure you don’t touch raw card data), the platform vaults the card. It gives you back a token – a random string that represents that card in future transactions. You can store this token in your database and use it to charge the customer later (through the orchestration platform). The actual card data stays in the vault which is heavily secured (encrypted, with access controls, regularly audited).

Tokens are usually universal within the platform: Meaning you can use the same token with any backend processor the platform connects to. This is powerful because it means if you decide to route recurring payments through a different acquirer next month, you don’t need to re-ask customers for their cards – the orchestration platform will use the saved token to charge via the new acquirer. The vault thus centralizes customer payment data, enabling a unified view of the customer’s payment instruments across channels (web, mobile, in-store, etc.).

Additionally, vaults can store other data: ACH bank accounts, direct debit mandates, even alternative methods like PayPal billing agreements or Apple Pay tokens – all under one roof. This not only enhances customer experience (say, enabling one-click checkout or cross-channel payment recognition) but also means full control of valuable data stays with you (via the platform) rather than scattered in different PSPs’ vaults.

Subscription Management Module

What it is: Tools to manage recurring payments (subscriptions) and related customer billing schedules.

Merchant pain point: Companies with recurring revenue models need to handle monthly charges, retries on failed payments, dunning emails for expiring cards, upgrades/downgrades, etc. Doing this manually or with a basic gateway’s limited subscription feature can be inadequate – you might end up with many involuntary churned customers due to failed payments.

How orchestration helps: If your orchestration platform includes a subscription module, it automates the entire recurring billing lifecycle:

You can create “subscription plans” (e.g., $50/month membership) in the platform.

Attach customers to these plans (using their tokenized payment method on file).

The platform will then automatically charge those customers at the set intervals. If a charge fails, it can schedule intelligent retries (e.g., retry in 3 days, then 5 days, using perhaps a different gateway if available). This significantly improves recovery of failed payments compared to a single immediate retry.

It can also handle proration if a customer changes plans mid-cycle, and generate invoices/receipts.

Many such modules also manage card updater services – for example, if a customer’s card expired, they work with networks’ account updater services to get the new card number/expiry in the vault, reducing declines. Some platforms report that automatic card update features help reduce decline-related revenue loss significantly.

All these tasks remove a huge operational burden from the merchant. Your team doesn’t have to run spreadsheets of who to charge when; the platform orchestrates it. And because it’s tied into the core payments engine, subscriptions benefit from the same routing optimization and tokenization. For instance, if your primary gateway is down on the day of billing, the platform could route those subscription charges to a backup automatically – your recurring revenue isn’t delayed.

SoftPOS and In-Person Payments Integration

What it is: “SoftPOS” stands for Software Point of Sale – essentially, it allows merchants to accept card payments in-person using just a mobile device (phone or tablet) instead of a traditional card terminal. In context of orchestration, this means the platform can integrate in-person payment acceptance with the same system.

Merchant pain point: Many retailers or service providers operate both online and offline. Historically, online payments and in-store payments are siloed – different systems, different vendors, leading to fragmented reporting and customer experience. For example, a customer might buy online and return in-store, which becomes complicated if the systems aren’t connected.

How orchestration helps: A modern payment orchestration platform with SoftPOS capabilities can unify online and offline channels. The platform might provide a mobile app or SDK that turns a device into a card reader (utilizing NFC for contactless card acceptance, for example). Transactions through this in-person channel then flow into the same orchestration backend. The ledger records them alongside online transactions, the tokenization vault can even tokenize card data from in-person taps (so a customer who bought in-store could have their card saved for an online profile, with consent).

For merchants, this means the orchestration platform becomes an omni-channel payment hub. You manage one system for all sales channels – very attractive for enterprise retailers, pop-up store scenarios, or say a food delivery company that also accepts card-present payments upon delivery. The softPOS integration usually still uses the platform’s routing intelligence. For instance, an in-store tap might still route through a processor that’s best for in-person rates. By combining this with your online processing, you might also negotiate better rates (your total volume is larger with both channels combined through one orchestrator).

Moreover, having a unified view helps with fraud and loyalty: You can detect fraud across channels (if a card was declined online for fraud, you can also flag it in-store), and you can implement unified loyalty or rewards (track customer spend both online and offline via the platform’s data).

Ledger & Reconciliation Module

What it is: The financial tracking heart of the platform – it logs every transaction event in a structured ledger and assists in reconciling those transactions with actual money movement.

Merchant pain point: With multiple providers, merchants often struggle to keep track of what happened to each payment. For example, a single customer order could have an auth, a capture, a partial refund, and then a chargeback – possibly handled by different systems. Ensuring the books balance (the amount captured minus refunds equals what arrives in the bank) is time-consuming. Missing funds or errors can go unnoticed without a proper system.

How orchestration helps: The platform’s ledger logs each event and ties related events together. It might use an internal database or even blockchain-like structure for immutability. You get a clear chain from authorization to capture to refund, etc., with timestamps and IDs. This is invaluable for customer service (e.g., “what happened with my payment?” – you can see it all) and accounting.

On top of that, the reconciliation module automates the matching of these logged transactions with external records. Many orchestration platforms will ingest payout reports from acquirers or processors – these show the net amounts paid to the merchant after fees. The platform can then match each transaction to the report, automatically marking them reconciled. Any that don’t match (missing or amount mismatch) will be highlighted. Some platforms also integrate directly with your bank or use daily cumulative totals to verify deposits.

For an enterprise handling thousands of daily transactions across providers, this eliminates hours of manual work and reduces financial risk. It ensures you actually receive the funds for all your approved transactions and can catch if, say, a PSP forgot to settle a batch. Additionally, a unified ledger means easier audit and compliance checks, because you can generate reports from one source that cover all payment activity.

Real-World Context: Merchant Pain Points and Solutions

To cement these modules in reality, let’s map a few common merchant pain points to how a payment orchestration process addresses them:

Pain Point: High decline rates or lost sales due to issuer/network issues.

Solution via Orchestration: Smart routing and cascading. If a transaction is declined by one bank for an ambiguous reason, the platform automatically tries an alternative path. Merchants often recover transactions that would have been lost. For instance, a travel merchant saw a noticeable jump in approvals when they started routing EU cards to a European acquirer instead of a US acquirer, all managed by the orchestration layer.

Pain Point: Integrating new payment methods or providers takes too long.

Solution: Pre-built integrations and modular architecture. With an orchestration platform, adding a new payment method (say Buy Now Pay Later option or a crypto payment gateway) might be as simple as a configuration toggle because the connector already exists. This means you can respond to market demands quickly, activating Apple Pay, Google Pay, PayPal, local wallets, etc., in days not months. It also alleviates engineering backlog – your dev team isn’t constantly building payment integrations, so they can focus on your core product.

Pain Point: Multiple dashboards and no unified reporting.

Solution: Central dashboard & unified data. The orchestration platform consolidates all transactions in one interface. Finance teams at a merchant no longer need to log into ten different PSP portals each morning to tally up transactions – they see everything on one screen. Beyond the convenience, this holistic view enables better decision-making (e.g., seeing the big picture of your payment costs and performance in real-time). One merchant described this as “having a mission control for payments” instead of flying blind across different systems.

Pain Point: Scaling to new countries is slow due to compliance and integration hurdles.

Solution: Orchestration simplifies global expansion. Need to start accepting payments in a new country? Your orchestration provider likely already supports a local gateway or local payment methods there. So you can enter the market and plug into the local payments ecosystem with minimal fuss. Additionally, compliance like PCI DSS, SCA, local data residency laws – many of these burdens are taken on by the platform (for example, it ensures PCI compliance so you don’t individually certify every new payment connection). This dramatically reduces time-to-market in new regions.

Pain Point: Difficulty managing subscriptions and reducing churn.

Solution: The subscription module automates retries and card updates, which recovers revenue. Merchants see subscription churn drop because the orchestrator catches scenarios like expired cards (using network token update services) or temporarily insufficient funds (retrying a few days later at a smarter time). This can add a few percentage points back into recurring revenue retention, which is huge for subscription businesses.

Pain Point: Fraud and security concerns.

Solution: By using an orchestration platform’s integrated fraud tools and by centralizing data, merchants often improve their fraud detection accuracy. You can feed more data into decisions (since all channels and providers report into one system, you have a 360-degree view of a customer’s activity). Also, security certifications like PCI DSS Level 1 come built-in – meaning the platform’s processes are audited and meet high security standards. This reassures both the merchant and their customers that payments are handled safely. Some platforms even allow multi-fraud-provider strategies (e.g., run Provider X’s scoring then double-check high-risk ones with Provider Y) – a complexity that orchestration makes feasible which was practically impossible to do manually.

In essence, each module of a payment orchestration platform is designed to automate and optimize a specific part of the payment journey, directly tackling the pain points that enterprise merchants commonly face. Instead of a loose patchwork of payment integrations, you get a well-oiled machine where all parts work in unison.

Insights

The payment orchestration process might seem complex, but it’s a necessity born out of the even greater complexity of today’s payment ecosystem. By breaking it down, we see that it’s a collection of smart, interconnected modules – each handling a critical function (routing, 3DS, tokenization, etc.) that used to require separate systems or heavy lifting by merchants.

For a decision-maker, the key takeaway is that a payment orchestration platform isn’t a black box – it’s a strategic toolkit. Knowing how its internal process works can help you leverage it better. You can fine-tune routing rules, customize fraud thresholds, schedule subscription retries – all to fit your business model – because you understand the engine under the hood.

In the next part, we’ll zoom out a bit and examine how orchestration plays out on a global scale. If your business transacts across borders, you’ll want to see how a global payments orchestration platform conquers regional challenges and optimizes international payments end-to-end.

Share:

Qaiware

Payment solution expert

OVER 15+ YEARS WE ARE BUILDING COMPLEX PAYMENT PRODUCTS FOR BLUE CHIP CLIENTS